Latest Insights.

What. |

How. |

Why. |

|

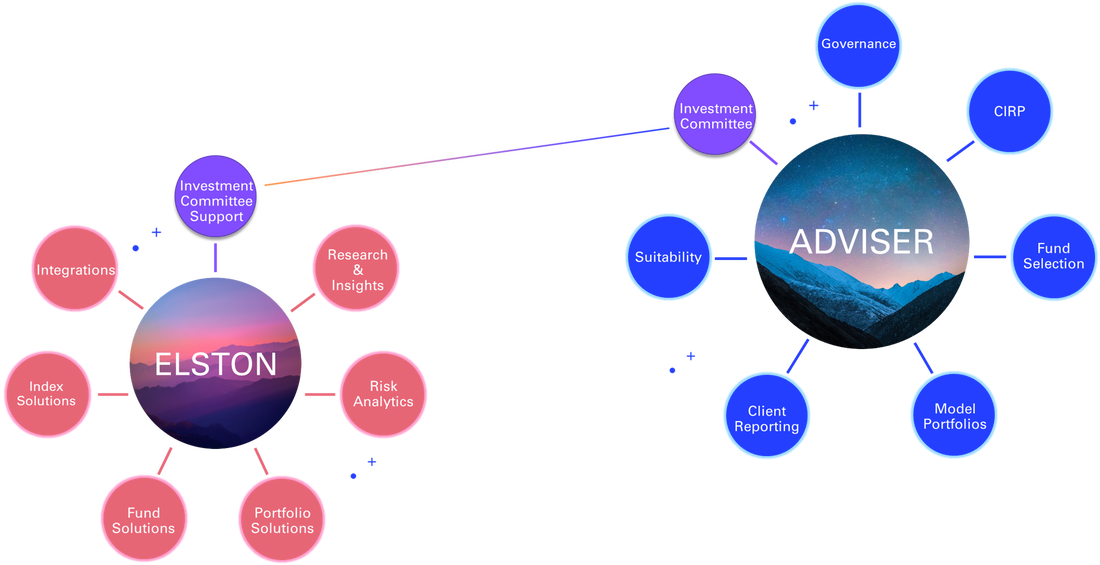

We are a team of experienced investment consultants that aim to support UK financial advisers with their investment solutions. We don't have a dogma or one-size-fits-all approach. We provide an institutional-quality toolbox using research, insights and analytics to help you with the risk management and oversight of your investment proposition.

|

We combine investment theory with practical experience to research, design and help you deliver an investment proposition in the format you require for your target market that can integrate with your suitability and governance processes. We can deliver strategies as Portfolios, Funds and Indices, depending on your requirements.

|

With advisers under increasing regulatory pressure to ensure they are delivering good outcomes to clients, having a professional partner to support your investment committee and broader investment proposition can help enhance business value and reduce business risk in a way that helps keep advisers in control.

|

What Our Clients Say.

Next Steps.

> Helping you transform your investment proposition & enhance your business value

Portfolios. |

Funds. VT Elston Liquid Real Assets Index Fund

VT Elston Multi-Asset Income Fund |

Indices. |

Stay informed. |

|

Vertical Divider

2012.

|

Vertical Divider

2012-14.

|

Vertical Divider

2014-15.

|

Vertical Divider

2016-20.

|

Vertical Divider

2020-Now.

|

Recognised experts in our field...

Making a difference beyond the Square Mile...